Selling a home can feel like a long, complicated process—especially if you’re dealing with banks, inspections, and endless paperwork. But what if you could skip all of that? Selling a house for cash is one of the fastest ways to close, often in just a week or two. So, how long does it take to close on a house with cash? It depends on a few factors, but the process is much quicker than a traditional sale. In this guide, we’ll break down how long it really takes, what’s involved, and how working with quick house buyers can help you sell your home fast with less stress.

Why Does a Cash Sale Close Faster?

A typical home sale can take 30 to 60 days—sometimes even longer—because of financing approvals, inspections, and other steps required by the buyer’s lender. A cash sale moves much faster because it skips the mortgage process entirely. Here’s why cash deals close quicker:

- No Bank Approvals – Cash buyers don’t need a mortgage, so there’s no waiting for loan approvals.

- Fewer Delays – Many cash buyers don’t require inspections or appraisals, which can slow things down in a traditional sale.

- Fast Title Work – A title search is still needed, but it usually moves quicker since there’s no lender involved.

- Flexible Closing Dates – Cash buyers can close on your schedule, whether that’s in a week or a month.

How Long Does It Take to Close on a House with Cash?

So, how long does it take to close on a house with cash? Well, if you’re working with a reliable cash buyer like Golex Properties, you can expect to close within 7 days—much faster than a traditional home sale. Without the need for lender approvals, appraisals, or lengthy inspections, the process moves quickly. Below is a detailed breakdown of each step, so you know exactly what to expect.

1. Accepting the Offer (1-2 Days)

Once you contact a quick house buyer, they will typically assess your home and present an offer within 24 hours. Some buyers may even provide a same-day offer, depending on how quickly they can evaluate the property.

- How does the buyer determine the offer?

- The buyer looks at the home’s condition, location, and market value.

- They factor in potential repairs, since cash buyers often purchase homes as is.

- Comparable sales in the area help determine a fair price.

- Do I have to accept the first offer?

- No. You can review the offer, ask questions, and even negotiate if needed.

- A reputable cash buyer will provide a transparent explanation of their offer.

Once you accept, the process moves to the next step quickly.

2. Signing the Purchase Agreement (1 Day)

The purchase agreement is a legally binding contract that outlines the details of the sale, including:

- The agreed-upon price

- The closing date

- Any special conditions, such as an as-is sale

How long does this step take?

- Typically, it’s completed within 24 hours after accepting the offer.

- The contract can often be signed electronically for convenience.

Can the sale fall through after signing?

- Not likely, since cash buyers don’t depend on bank financing.

- However, if title issues arise, they may need to be resolved before closing.

With the purchase agreement signed, the next step is to verify the title.

3. Title Search and Property Check (3-5 Days)

A title search is conducted to ensure there are no legal issues tied to the home, such as:

- Unpaid taxes or liens – If money is owed on the property, it must be settled before the sale.

- Ownership disputes – The title company ensures the seller has the legal right to sell.

- Pending legal claims – Any lawsuits or claims against the property must be addressed.

- Does a title search delay closing?

- In most cases, no. Title companies can expedite this process for cash buyers, usually completing it in 3 to 5 days.

- If an issue is found, it may take longer, but a good cash buyer will work with you to resolve it quickly.

Once the title is cleared, you’re almost at the finish line.

4. Closing and Getting Paid (1 Day)

Closing is the final step, where ownership of the home is officially transferred to the buyer.

- What happens at closing?

- You’ll sign the final paperwork to complete the sale.

- The title company or attorney overseeing the process will ensure everything is legally recorded.

- The buyer provides payment, typically through a wire transfer or certified check.

- How soon do I get paid?

- Most sellers receive their funds the same day or within 24 hours after closing.

- Do I have to be there in person?

- Not necessarily. Many closings can be handled remotely with electronic signatures.

Total Time: About 1-2 Weeks

- Fastest timeline: 7 days (if everything moves smoothly).

- Average timeline: 10-14 days.

- Longer timeline: Up to 3 weeks (if title issues arise).

Selling for cash eliminates the delays of traditional home sales, making it the quickest and easiest way to sell your home—especially if you need to move fast.

How Does a Cash Sale Compare to a Traditional Sale?

Selling a home is a big decision, and the process can vary depending on how you choose to sell. The two main options are selling to a cash buyer or going the traditional route with a real estate agent and listing your home on the market. While both methods have their advantages, a cash sale is significantly faster and more straightforward, making it the best option for those who need to sell quickly.

Below, we’ll break down the differences between a cash sale and a traditional home sale so you can make the best choice for your situation.

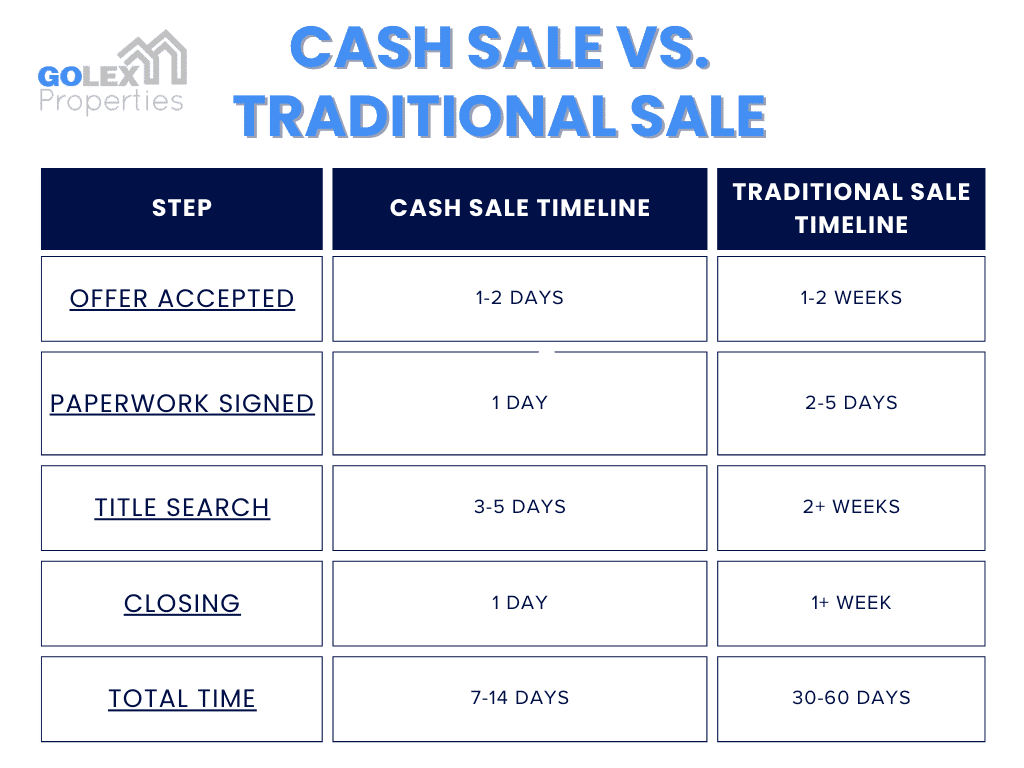

Side-by-Side Comparison: Cash Sale vs. Traditional Sale

A traditional sale often takes one to two months to close—and sometimes even longer—while a cash sale can be completed in just one to two weeks.

Breaking Down the Differences

1. Accepting an Offer

- Cash Sale: You’ll typically receive an offer within 24 hours to 48 hours after a cash buyer evaluates your property. Because they don’t need mortgage pre-approval, cash buyers can make fast decisions.

- Traditional Sale: You’ll need to list your home on the market, schedule showings, and wait for interested buyers to submit offers. This process can take weeks or even months, depending on market conditions.

Which is better?

- If speed is your priority, a cash sale wins since there’s no waiting for buyers to go through financing approvals.

2. Signing the Paperwork

- Cash Sale: Once you accept the offer, the purchase agreement can be signed within a day, often electronically for convenience.

- Traditional Sale: The contract process takes longer since both the buyer and seller must go through additional steps like negotiations, contingencies, and mortgage pre-approval. This can take several days or even weeks..

Which is better?

- A cash sale keeps things simple, reducing the risk of delays or last-minute contract changes.

3. Title Search & Due Diligence

- Cash Sale: A title company will conduct a title search to ensure there are no legal issues (like unpaid taxes or liens) on the property. This typically takes 3 to 5 days but can be expedited in many cases.

- Traditional Sale: The title search is required by lenders, and because banks have their own verification processes, this step can take two weeks or more. If issues arise, it can delay closing even further.

Which is better?

- Cash sales move faster because there are fewer people involved in the approval process.

4. Closing & Getting Paid

- Cash Sale: Once the title is cleared, the final paperwork is signed, and the cash is transferred within 24 hours—sometimes even on the same day.

- Traditional Sale: Lenders require additional steps, including final loan approvals, appraisals, and a waiting period before funds are released. This means closing can take another week or more.

Which is better?

- If you need to get paid quickly, a cash sale is the best option because you don’t have to wait for a lender to fund the transaction.

Total Time: How Long Does Each Process Take?

- Cash Sale: 7-14 days, from the offer to closing.

- Traditional Sale: 30-60 days—or longer if financing issues, inspections, or buyer contingencies slow things down.

Why does a traditional sale take longer?

- Mortgage approvals take time – Banks require income verification, credit checks, and appraisals before approving a loan.

- Inspections can cause delays – If an inspector finds problems, repairs may need to be completed before closing.

- Buyers can back out – If a buyer’s financing falls through, they may cancel the contract, forcing the seller to start over.

Why Choose a Cash Sale?

If you need to sell fast and avoid stress, a cash sale is the clear winner. Here’s why:

- No waiting for buyer financing – Cash buyers don’t need bank approvals, so the sale isn’t dependent on a lender’s timeline.

- No appraisals or inspections – Many cash buyers purchase homes as is, meaning no need to fix anything before selling.

- Fewer contingencies – Traditional buyers often include contingencies (such as needing to sell their current home first), which can slow down the process or cause deals to fall through.

- Guaranteed closing – A cash buyer has the funds ready, so once the contract is signed and the title is clear, the sale is final.

Is a Cash Sale Right for You?

A cash sale is the best option if:

- You need to sell fast due to a financial situation, job change, or personal reasons.

- You don’t want to deal with repairs or home improvements before selling.

- You have tenants in the property and want to sell without evicting them or waiting the length of the lease.

- You own an inherited home and want a simple, hassle-free way to sell.

- You live out of state and don’t want to manage a long-distance sale.

On the other hand, if you have time to wait and want to maximize your sale price, a traditional sale may be a better fit. However, keep in mind that a traditional sale comes with additional costs like:

- Real estate agent commissions (typically 5-6% of the sale price).

- Closing costs (which can add up to 2-5% of the sale price).

- Home repairs or staging expenses to attract buyers.

Selling a home traditionally can take months, with no guarantee that the sale will go through. A cash sale eliminates the uncertainty and gets you paid fast.

Who Should Consider Selling for Cash?

Selling a house for cash isn’t just for people in a hurry—it’s also a smart choice for homeowners who want a stress-free, guaranteed sale without dealing with banks, agents, or months of waiting. Whether you need to sell quickly due to a life change, financial hardship, or simply want an easier way to offload a property, a cash sale can be the best option.

Below are some of the most common situations where selling for cash makes sense.

1. Homeowners Facing Financial Issues

Financial struggles can be overwhelming, and selling a house through the traditional real estate market isn’t always practical when you need a fast solution. If you’re dealing with any of the following, a cash sale might be the best way to get out of a tough situation quickly:

- Foreclosure risk – If you’ve fallen behind on mortgage payments and your lender is threatening foreclosure, selling to a cash buyer allows you to avoid foreclosure and protect your credit.

- Mounting debt – A fast sale can provide immediate cash to pay off debts and give you financial breathing room.

- Job loss or reduced income – If you can’t afford your mortgage anymore, selling for cash can help you move on without financial strain.

How fast can I sell if I’m in financial trouble?

- Most cash buyers can close in as little as 7 days, meaning you can settle your finances quickly without months of uncertainty.

Will I still get a fair price?

- A reputable cash buyer will give you a fair market offer, considering your home’s condition and location.

2. Landlords with Tenants in Place

Owning a rental property can be profitable, but it also comes with challenges—especially when it’s time to sell. If you have tenants still living in the home, selling on the open market can be difficult since many buyers want a vacant property.

- Uncooperative tenants – Some tenants may make showings difficult or refuse to leave before closing.

- Lease agreements – Selling a home with active leases limits your pool of potential buyers.

- Tenant-caused damage – Some rental properties may have wear and tear that makes selling harder.

Can I sell a house with tenants still living in it?

- Yes. Many cash buyers, including Golex Properties, specialize in purchasing rental homes with tenants still in place, so you don’t have to deal with evictions or negotiations.

Do I need to notify my tenants?

- This depends on your lease agreement and local laws. However, selling to a cash buyer who assumes the lease can make the process much easier.

3. Owners of Inherited Homes

Inheriting a home can be a blessing, but it can also be a burden—especially if you don’t want to manage an extra property. Whether you’re dealing with tax obligations, maintenance costs, or family disputes, selling for cash is often the simplest way to move forward.

- Outdated homes – Many inherited homes need updates or repairs that you may not want to deal with.

- Shared ownership – If multiple family members inherit a house, selling for cash can provide a quick and fair resolution.

- Emotional stress – Managing an inherited home can be overwhelming, and a cash sale provides a fast, hassle-free exit.

Do I have to clean out the house before selling?

- No. Many cash buyers will purchase the home as is, meaning you can leave behind unwanted belongings.

What if the house is still in the estate process?

- A reputable cash buyer can work with you to close once probate is completed, ensuring a smooth transition.

4. Out-of-State Homeowners

If you own a property in another city or state, managing it from a distance can be time-consuming and expensive. Whether it’s a former home, vacation property, or rental, trying to sell from far away adds challenges like:

- Coordinating repairs – Getting a home ready to sell while living elsewhere is difficult and costly.

- Traveling for showings – Flying back and forth for open houses and negotiations isn’t practical.

- Handling paperwork remotely – Many traditional sales require in-person closings.

Can I sell a house from another state?

- Yes. A cash buyer can handle the entire process remotely, from making an offer to closing, without you ever needing to travel.

How do I get paid?

- Your payment will be sent through a secure wire transfer, typically on the same day as closing.

5. Owners of Homes That Need Repairs

Not every house is in perfect condition—and that’s okay. But if your home needs major repairs or updates, selling through a real estate agent can be tough. Many traditional buyers want move-in-ready homes, and repair costs can add up fast.

- Structural issues – Problems like foundation damage or a leaking roof can scare off buyers.

- Outdated interiors – If your home hasn’t been updated in decades, it may struggle to compete on the market.

- Mold or water damage – Many lenders won’t approve loans for homes with serious issues.

Do I have to make repairs before selling for cash?

- No. Cash buyers purchase homes as is, meaning you don’t have to spend a dime on repairs.

Will a damaged home still sell for a good price?

Yes. While the price will reflect repair costs, cash buyers make fair market offers based on the home’s potential value.

Finding the Right Quick House Buyer

Not all cash buyers are the same. To make sure you’re working with a trustworthy company, look for:

- Good Reviews & Experience – A company with a strong track record of fast, fair sales.

- Clear, Honest Offers – Watch out for hidden fees or lowball offers.

- Flexible Closing Options – A buyer who can work around your timeline.

- No Repair Requirements – The right buyer will take the home as is without asking for fixes.

- Non-Florida/Georgia Approved Contracts – Some cash buyers use non approved contracts and may include terms that are not in the seller’s interest.

Sell Your Home Fast with Quick House Buyers Like Golex Properties

At Golex Properties, we buy homes for cash in Florida and Georgia, closing in as little as a week. Whether you’re dealing with a tough situation, an unwanted rental property, or just want a fast, hassle-free sale, we make it simple and stress-free.

Ready to sell? Contact us today to get your cash offer!