Blog

Blog

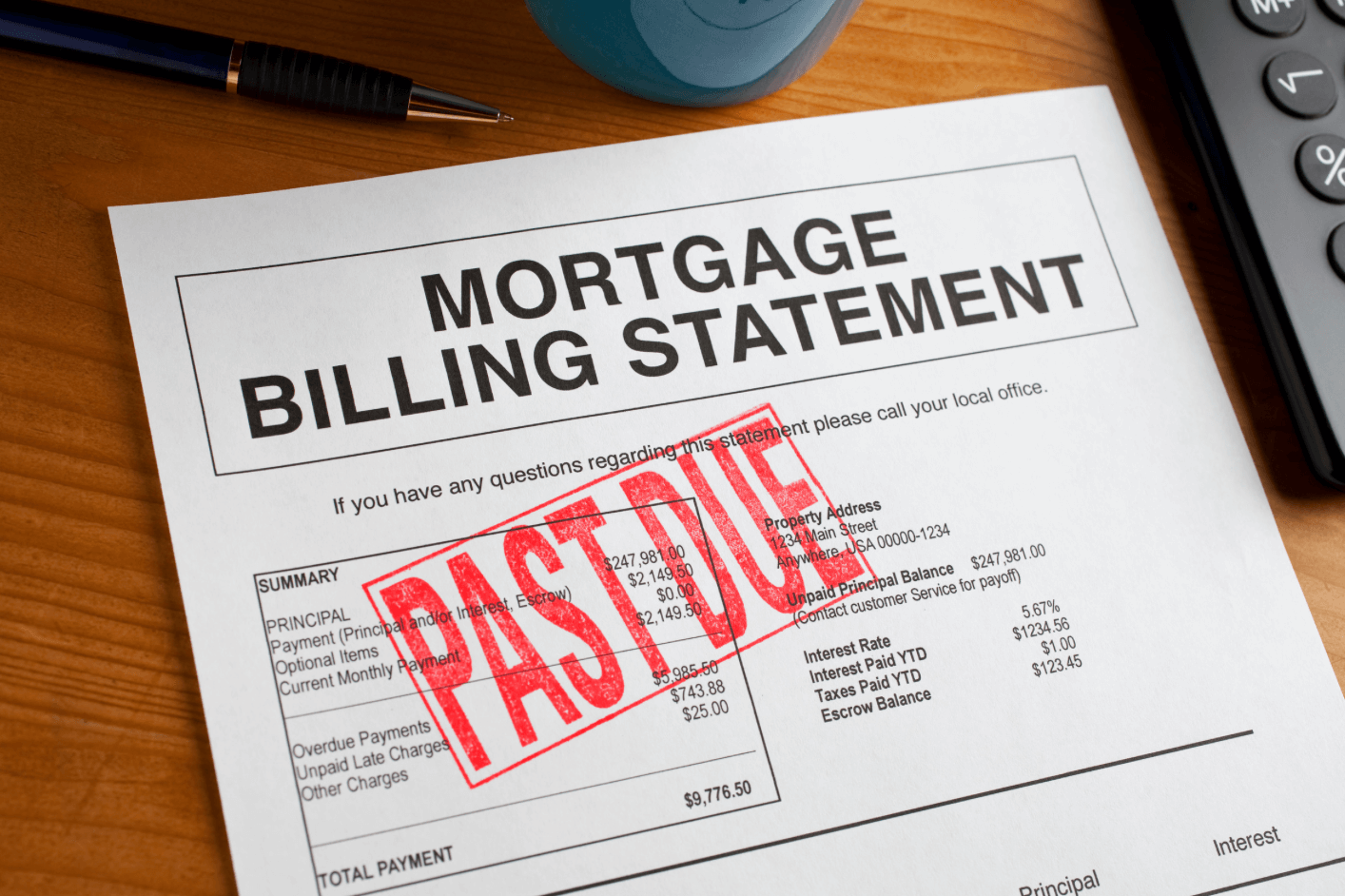

Owning a home is a dream for many, but finding yourself in a situation where you owe more on your mortgage than your home is worth can be stressful. If you're in this scenario, here are some selling options you can consider.

An upside-down mortgage, also known as negative equity, occurs when you owe more on your mortgage than the current market value of your home. If you don't know whether you're in such a situation, here's an example to help you decide.

Say you purchased your home for $500,000, and its value drops to $450,000 for some reason. If you still owe $480,000 on your mortgage, you're in an upside-down situation by $30,000.

Here are some selling options to consider when your upside down on your mortgage:

A short sale is when you sell your home for less than what you owe on the mortgage, and the lender agrees to accept that amount as full payment. This option can be great if you can't afford to continue to own your property.

Explain to your lender that you can't afford to pay your mortgage by showing financial documents like bank statements and tax returns. Once you find a buyer for your property, the lender will review and approve the deal. If the lender approves the sale, you can transfer the property to the new owner.

A deed in lieu of foreclosure is like a short sale. However, instead of transferring ownership to a new buyer, you transfer it back to the lender. If you're facing foreclosure, choosing this option is the best.

To qualify for this arrangement, you should prove that you tried to find a buyer but were unable to do so. The lender will also ask for your financial documents, like bank statements and tax returns, to ensure that you qualify for a deed in lieu of foreclosure.

If feasible, wait for the market conditions to improve so that you can sell the property without a significant loss. However, remember that you don't wait so long that your mortgage keeps increasing.

Note: There are many more selling options if you find yourself upside down on your mortgage. However, those processes are time-consuming and require a lot of paperwork and negotiation, making them impractical for people who need to sell their property quickly before the mortgage adds up even more.

How long does it take to recover from mortgage loss financially?

The time varies depending on individual situations. Be patient and consult with a professional to develop a strategic plan for financial recovery.

Which is better: purchasing a home in cash or through a mortgage?

Cash is a better option as you can save at least 10%.

What should I do to make my home more appealing to buyers?

Here's all you can do to make your home more appealing:

Being upside down on your mortgage is undoubtedly stressful. However, it doesn't mean you're out of options. Explore your choices and make an informed decision depending on your situation.

Recovering from financial challenges takes time, but with careful planning, you can navigate them effectively. Buying a property with cash is any day better than buying it through a mortgage.

If you need help selling your home, contact Golex Properties. We make the process stress-free by handling everything for you, from listing and marketing your home to closing the sale.

Contact us for a FREE, no-obligation consultation. Golex Properties simplifies the process!

Easy to contact us

@ Copyright 2023. All rights reserved